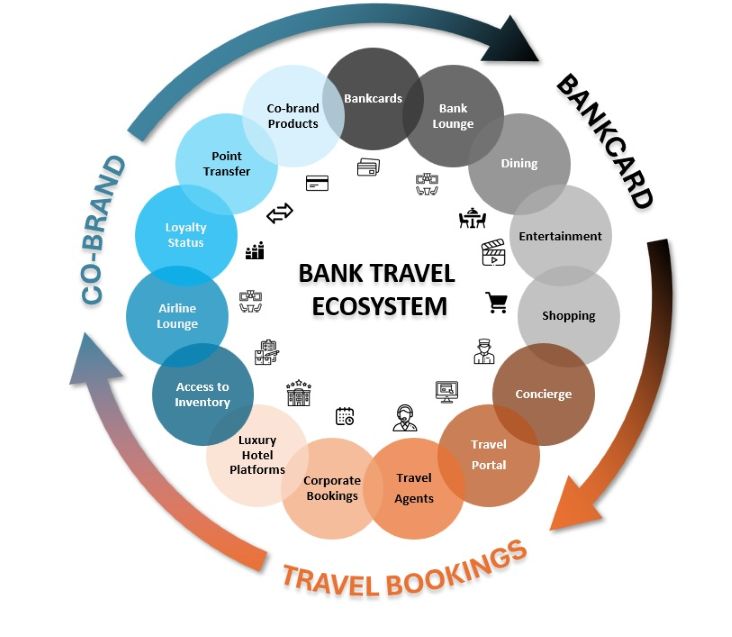

The travel credit card landscape is undergoing a significant transformation as banks such as Chase, American Express, and Capital One expand their influence beyond traditional card offerings into fully integrated travel ecosystems. Once largely reliant on currency flexibility, offering cash-back, the ability to redeem on any airline, and no blackout dates, these banks are now building proprietary platforms that position them as both collaborators and competitors to traditional travel providers. By investing in travel assets and earning commissions on bookings, similar to online travel agencies, banks aim to control a larger portion of the customer journey and unlock new revenue streams beyond interchange, fees and interest income. This expansion is not limited to core travel: banks are also moving into adjacent lifestyle categories like dining. American Express’s acquisition of Resy and Tock and Chase’s Infatuation exemplify how issuers are integrating exclusive dining access, priority reservations, and culinary events to deepen customer engagement.

One of the most visible signs of this shift is the level of investment that banks are making in exclusive lounge networks. American Express notably pioneered this trend with its Centurion Lounges, opening its first in 2013, establishing a new benchmark for premium travel benefits independent of airline control. Following Amex’s playbook, Chase has launched its own Sapphire Lounges, and Capital One launched Capital One Lounges. These spaces are more than just comfortable retreats; they are strategic brand assets that offer a tangible, elevated travel experience and generate a halo effect around the banks’ premium travel products – allowing them to go toe-to-toe with premium airline co-brand cards. By developing their own lounge footprints, banks reduce dependence on airline partners for premium benefits, gaining greater control over the customer experience and fostering brand loyalty on their own terms.

Simultaneously, banks are expanding deeper into the travel booking space, traditionally dominated by online travel agencies. At Chase’s 2025 Investor Day, the bank reported 4.2 million customers booking travel, a 24% CAGR since 2021, resulting in Chase being the #3 largest consumer leisure travel provider. Platforms such as Amex’s Fine Hotels & Resorts (FH&R) and Chase’s The Edit allow premium cardholders to book curated luxury hotels directly within the banks’ ecosystems. The benefits offered through these programs often rival or exceed those available to the hotel’s elite loyalty members, including early check-in, late check-out, room upgrades, property credits, and complimentary breakfast. These overlapping offerings provide travelers with an incentive to book through bank portals rather than directly with hotels, enabling banks to earn commissions on travel sales and capture incremental revenue beyond traditional card spend. This strategy is further reinforced by elevated earn rates within these ecosystems. For instance, the newly refreshed Chase Sapphire Reserve Card offers 8x points on travel purchased through Chase Travel (compared with 4x on direct bookings) and introduced $500 in The Edit statement credits annually, driving even more volume into its proprietary travel platform.

Yet despite these ambitions to build proprietary travel ecosystems, banks remain intricately connected to their airline and hotel co-brand partners. This relationship is a complex blend of cooperation, competition, and emotion. Co-brand partners provide valuable perks and status recognition; for instance, Marriott and Hilton share elite status recognition on Amex’s branded cards, while Delta offers lounge access through the American Express Platinum card. Beyond these benefits, points transfer relationships further deepen this collaboration by increasing the flexibility, redemption value, and overall utility of bank loyalty currencies. These transfer partnerships enable cardholders to convert bank points into airline miles or hotel points, enhancing travel options and engagement. At the same time, they provide airline and hotel partners with a meaningful share of the economics generated by the growth in bank proprietary travel cards, aligning incentives across the ecosystem. These benefits remain critical to attracting and retaining premium customers.

At the same time, most airline and hotel partners view bank travel ecosystems as competitive threats to varying degrees. Hotels, for example, rely heavily on Amex’s Fine Hotels & Resorts and increasingly on Chase’s The Edit for a significant share of their luxury bookings, potentially diverting spend away from their own co-branded cards and direct booking channels. This rapidly evolving dynamic creates inherent tension as banks seek to leverage partners’ inventory and established brands while simultaneously building direct-to-consumer travel products and services that reduce dependency on traditional co-branded relationships.

This complex dynamic is influencing the direction of legacy co-brand card arrangements, card benefits, and partnership strategies. Increasingly, certain banks position themselves not merely as credit card issuers but as travel lifestyle brands aiming to capture a greater share of the travel value chain. Airlines and hotels, in turn, face the challenge of evolving their proprietary loyalty and co-brand programs to remain relevant and competitive. The broader implication for co-brand partners in the T&E segment is clear: they must make critical strategic decisions about the depth of their bank partnerships and the extent to which they share their assets versus protecting them as key pillars of differentiation.

Banks building proprietary lounges and expansive platforms for travel booking, dining and entertainment, shopping, as well as points transfers are staking their claim as central players in travel, with the potential to reshape the traditional balance of power between banks and their co-brand card partners in the travel segment. For airlines and hotels, the path forward requires balancing collaboration with competition, as each party navigates the tension between shared benefits and competing interests. As travel ecosystems continue to evolve, we expect intensified competition not only for share of wallet but for ownership of the entire travel experience.